The 8 Investing Rules (a cheat sheet)

Apr 12, 2025Read time - 3.5 minutes / Disclaimer

Investing rules help you figure out:

- How long to invest.

- How much to invest.

- When to leave the 9-5.

Unfortunately, they don't teach these rules in school.

Building Wealth

School covers many topics, but doesn't cover:

- Saving money.

- Investing money.

- Planning your 9-5 escape.

Much of this becomes a game of trial and error.

A game of trying to avoid money mistakes (I've made my fair share).

Fortunately, mistakes are just lessons in disguise.

A few painful ones I've made:

- Getting fired.

- Almost filing bankruptcy.

- Having $55k on credit cards.

As tough as these were.

I was still able to:

- Build a $1M net worth

(stocks + real estate)

- Escape 9-5 life early

(left the cubicle in 2020)

You can mess up your finances pretty bad.

But life keeps giving you chances to turn things around.

If you're starting at $0 (like I did) or trying to fine-tune your money goals.

Here's 8 investing rules that helped me on my journey (I hope they help you too).

Let's dive in:

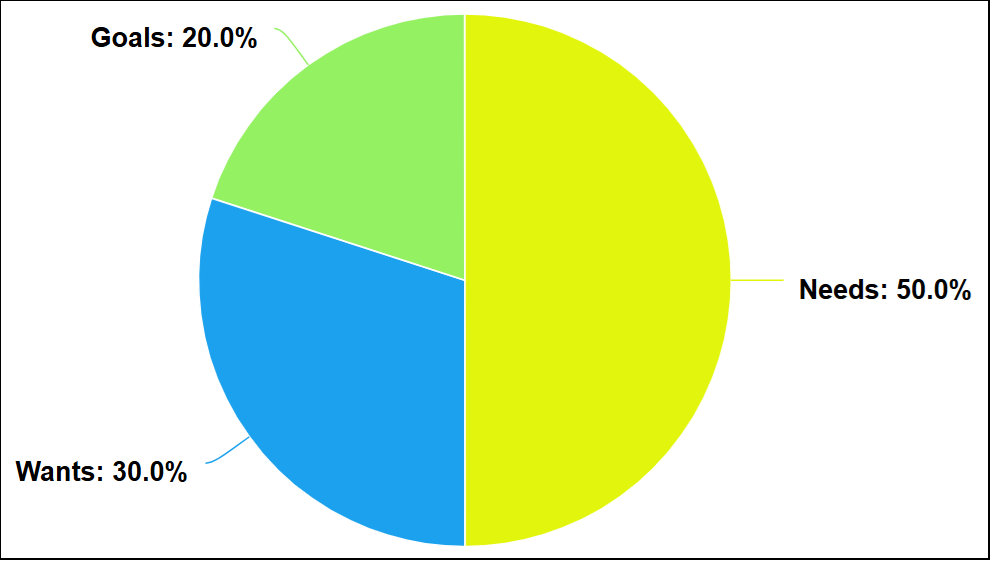

1. The 50/30/20 Rule

Budget your income based on:

- 50% Needs

(food, rent, etc)

- 30% Wants

(vacations, new cars, etc)

- 20% Goals

(investing, debt payoff, etc)

Balancing how you spend your income helps ensure money is available to invest.

2. The 3X Emergency Rule

Build a cushion of money for life's uncertainties.

Instead of having 100% of your paycheck go into a checking account.

- Have 90% go into checking.

- Have 10% go into savings.

This helps build up your savings automatically.

Saving 3 months of your monthly expenses helps you navigate the unexpected.

3. The 100 Minus Age Rule

Balance your investments.

This rule helps you decide how much to invest in stocks and other assets.

Subtract your age from 100.

For example:

If you're 30.

100 - 30 = 70

You'd invest 70% of your assets in stocks.

And 30% in other assets like real estate, bonds, etc.

Investing in different assets helps ensure you're not betting the farm on one thing.

4. The 10-5-3 Rule

Investments grow differently.

For example:

- Stocks grow 10% per year on average.

- Bonds grow 5% per year on average.

- Savings accounts average 3% per year.

Knowing how quickly different investments grow helps you set realistic goals.

5. The Rule of 72

Find out how long it takes your investment to double.

Divide 72 by the average growth rate of your investment.

For example:

If stocks average 10% per year.

72 Divided by 10 = 7.2

This means stock prices double every 7.2 years on average.

Knowing how long it takes your investments to double helps you plan long term.

6. The Rule of 70

Inflation steals your purchasing power.

To find out how often prices double.

Divide 70 by the current inflation rate.

For example:

If the inflation rate is 3%

70 Divided by 3 = 23.3

This means prices double every 23.3 years on average.

Understanding how often prices double helps you set realistic investing goals.

7. The Rule of 300

Find out how much money you need for retirement.

Take your current monthly expenses and multiply that number by 300.

This gives you a rough estimate as to how much money you'll need to live your current lifestyle in retirement.

Knowing your monthly retirement expenses helps you plan long term.

8. The 4% Withdrawal Rule

Find out how much you can spend in retirement.

This rule says you can spend 4% of your money each year.

For example:

If you have $1M invested.

4% of $1M = 40,000

That means you can spend $40,000 per year.

Experts say a balanced investment portfolio will last about 30yrs using the 4% rule.

The Bottom Line

It's important to remember.

These rules are just a guideline.

Real life isn't black and white.

For example:

Rule 8 "How Much You Need To Save To Retire".

These numbers assume you never work again.

That's not the case for most people.

Leaving the 9-5 isn't about never working again.

It's about doing things you truly enjoy at your own pace and being intentional with your time.

For many people this often means working part time:

- For yourself.

OR

- As a part time employee.

Most people receive social security too at some point (or other retirement income).

I've found these rules useful while planning my early exit from 9-5 life.

I hope they help you too.

Keep building 💰

See you next week.